Confidence in Europe falters but UK bucks downward trend

09 August 2024

Stuttgart 21 construction site for new railway train station (Photo: AdobeStock)

Stuttgart 21 construction site for new railway train station (Photo: AdobeStock)

Summer may have finally made a belated appearance across Europe in July but the outlook for the region’s construction sector looked considerably gloomier.

That’s according to the latest figures from a series of surveys measuring construction activity in some of Europe’s biggest economies over the course of the month.

Activity in the Eurozone as a whole, as well as in the individual economies of Germany, Italy and France all saw declines in what should be one of the sector’s busiest periods.

But it proved to be a different story in the United Kingdom (UK), whose construction sector bucked the trend and enjoyed the fastest rate of increase in activity for 26 months.

‘Broad-based’ decline in Europe

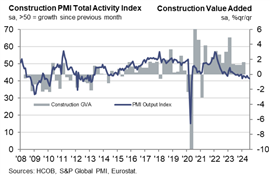

The headline figure from the Hamburg Commercial Bank (HCOB) Eurozone Construction Purchasing Managers’ Index (PMI), which measures construction buyers’ perception of output levels in the industry, was 41.4 in July.

Any score on the index lower than 50.0 indicates a decline in activity, with any score above 50.0 pointing to an increase. July’s figure was down slightly from 41.8 in June and indicated a steep decrease in the Eurozone in the second half of the year.

HCOB Eurozone Construction PMI to July 2024

HCOB Eurozone Construction PMI to July 2024

It was residential construction that proved to be the weakest link, with flagging demand for housing driving the overall downturn.

S&P Global reported that European construction companies were “downbeat” in their expectations for the coming year, with the degree of pessimism in July worsening from June.

Calling the downturn “broad-based”, Norman Liebke, economist at Hamburg Commercial Bank, said, “The housing sector weighed on overall construction activity again. In July, housing activity dropped for yet another month due to weak demand conditions, also leading to another round of job shedding as the employment situation worsened in July. Commercial activity also worsened by the downturn in the civil engineering sector softened compared to June, mainly due to France.”

Deep contractions in Germany starting to slow?

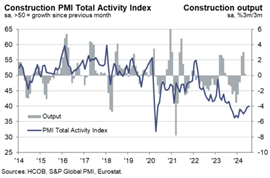

The headline figure from HCOB’s PMI for Germany was 40.0, which indicated that construction sector activity is still deep in contraction.

However, July’s figure was a slight improvement on June’s 39.7 and the rate of decline has eased for the third month in a row.

HCOB Germany Construction PMI to July 2024

HCOB Germany Construction PMI to July 2024

Germany has been in the grip of a property crisis since 2022, when soaring inflation made housing less affordable while also prompting the European Central Bank to raise interest rates, making borrowing more expensive.

Unsurprisingly, it was the residential construction sub-sector that recorded the steepest decline in Germany during July, accelerating as compared to June. There were also decreases in activity in both commercial work and civil engineering, according to the index, although these were the least marked for three and nine months respectively.

Nonetheless, new orders continued to fall, prolonging a decline that has lasted for nearly two and a half years. Even though the rate of decline eased to the lowest level since early 2023 in June, it reaccelerated in July.

That coincided with a decline in confidence among Germany construction firms, who declared themselves more pessimistic in July than they had been in June, even as the rate of decline in activity in the sector slowed. Around 41% said they expected to be building less next year, compared to 9% who were optimistic about expanding.

Construction companies also reported cuts to workforce numbers and purchases of building materials in July, in line with their gloomy expectations. However, the rate of job shedding did at least slow for the second month running to the lowest level since February this year.

Commenting on the data, Dr. Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, said, “The most positive thing that can be said about these figures is that the slump in construction has slowed down a bit recently. This is especially true for commercial building activity and civil engineering projects, while residential construction took even a slightly bigger hit in July than in June.”

He did point to the renovation of 40 railway lines, scheduled to start in mid-July and ending in 2030, as having the potential to lend some impetus to civil engineering.

Declines in France accelerate

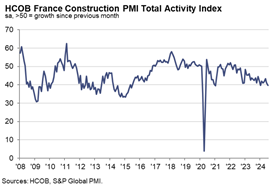

France is in the grip of a deep decline in construction activity, with residential building once again the main culprit. Housing construction declined at one of the most marked rates since data was first collected in September 2000.

Work on commercial projects also declined sharply, and civil engineering activity also dropped, although to a weaker extent than in June.

The headline figure from the HCOB PMI was 39.7 in July, which was down from 41.0 in June, the fastest decrease since January this year.

HCOB France Construction PMI to July 2024

HCOB France Construction PMI to July 2024

Meanwhile, French construction buyers reported the sharpest decline in incoming new work in nearly three and a half years. Companies responded by reducing their purchasing activity and reducing staffing levels for the third month in a row.

More than a third of panellists surveyed said they expected a reduction in the amount of work over the coming year.

Commenting on the figures, Liebke said, “It doesn’t look good at all.

“Overall, demand weakened even further as the new orders index turned down yet again, which is reportedly due to some difficulty for clients securing loans, according to anecdotal evidence. Although we expect another interest rate cut by the ECB in September, this will hardly revive the French construction sector.

“Thus, we anticipate that the sector will remain in recession for this year.”

Italy suffers collapse in demand

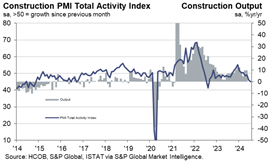

The headline figure from HCOB’s PMI for Italy declined from 46.0 in June to 45.0 in July, as new orders fell at their fastest rate for nearly two years, signalling a drop in demand.

Italy had been showing some resilience to Europe’s downward trend, thanks in part to hundreds of billions of Euros worth of government subsidies including the ‘Superbonus’ programme, which offered fiscal incentives for home renovations.

HCOB Italy Construction PMI to July 2024

HCOB Italy Construction PMI to July 2024

But that programme has now ended and all three sub-sectors recorded a fall in activity during July, with residential building again the main drag.

A quarter of companies surveyed said they had experienced a decline in new orders, compared to 16% who registered an improvement.

Opinion on where the sector goes from here appeared to be split, with some companies confident that conditions would improve and others expressing doubts. Overall, the degree of optimism was at its lowest level for two years.

Jonas Feldhusen, junior economist at Hamburg Commercial Bank, said: “The primary factor driving this downturn was collapsing demand. July marks the fourth consecutive month of declining demand, with the rate of decline accelerating for the second consecutive month, as indicated by the New Orders Index.”

“After the end of the Superbonus program, the situation in Italy’s construction sector is exacerbating. While we anticipate another interest rate cut by the ECB in September, which would naturally benefit the construction sector, it is doubtful that this decision will provide a significant boost.”

UK construction a bright spot

While no longer a member of the European Union, it was a different story in the Eurozone’s near neighbour of the UK.

Here, the S&P Global UK Construction PMI registered a headline score of 55.3 July up from 52.2 in June, as the country experienced a bounce in new orders following the conclusion of a general election that saw Sir Keir Starmer’s Labour government take power.

S&P Global UK Construction PMI to July 2024

S&P Global UK Construction PMI to July 2024

The rate of expansion was the fastest since May 2022 and marked the fifth consecutive month of growth.

All three sub-sectors of the construction industry saw growth but the fastest rate was in civil engineering.

New orders expanded for the sixth month running and construction buyers reported stronger consumer confidence that made clients more willing to release previously paused projects. Subcontractor usage also rose for the fourth month running.

But the rate of input cost inflation also showed signs of picking up amid improving demand.

Andrew Harker, economics director at S&P Global Market Intelligence, said: “The election-related slowdown in growth seen in June proved to be temporary, with the pace of expansion roaring ahead in July. Firms saw the strongest increases in new orders and activity since 2022 as paused projects were released amid reports of improved customer confidence. “The strength of demand moved the sector closer to capacity, bringing a recent period of improving supplier performance to an end. There were also signs of inflationary pressures picking up, something that will need to be watched closely if demand strength continues in the months ahead.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM