Global construction can look forward to stronger 2025 (with one possible exception)

07 October 2024

Image: Emily via AdobeStock - stock.adobe.com

Image: Emily via AdobeStock - stock.adobe.com

Spending on construction in economies around the world looks set to rebound in 2025, with one possible exception.

That’s according to exclusive analysis of the industry’s prospects around the world from Scott Hazelton, consulting director at S&P Global Market Intelligence, presented at the Cranes & Transport Middle East Conference in Dubai last week.

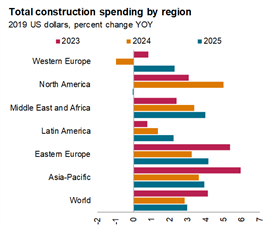

Hazelton explained that declining inflation combined with expected interest rate reductions by central banks around the world should lead to increased construction spending in nearly every region of the world in 2025 (see chart below).

S&P Global Market Intelligences’ Scott Hazelton delivered a presentation on the Global Construction Outlook to Cranes & Transport Middle East last week.

S&P Global Market Intelligences’ Scott Hazelton delivered a presentation on the Global Construction Outlook to Cranes & Transport Middle East last week.

But there’s one major market where S&P Global Intelligence expects spending levels to go into reverse in 2025, after a very strong 2024 and that’s North America.

“Globally, we are looking at a relatively decent forecast,” Hazelton told delegates. “2024 has been weaker than last year but 2025 will get stronger.

“That is true in most parts of the world with the exception being North America where we have two problems: One is expiring stimulus money on infrastructure, hence probably a peak right now, with spending on roads and bridges, water and sewer; Also the CHIPS Act, which was responsible for large amounts of manufacturing construction has also probably peaked.

“Finally, we have a pretty anaemic housing market within America, so that is the one weak spot”.

While spending levels in North America are forecast to decline slightly in 2025, that is of course off the back of strong increases in spending in both 2023 and 2024.

Source: S&P Global Market Intelligence (data compiled in July 2024)

Source: S&P Global Market Intelligence (data compiled in July 2024)

Infrastructure still strong, residential still challenging

Infrastructure is forecast to be the strongest source of construction spending growth across the world in 2025, but at reduced rates as stimulus spending wanes in both the Eurozone and US. Nonetheless, the US Infrastructure Investment and Jobs (IIJA) and Inflation Reduction Act (IRA), which aims to promote green energy projects, will keep growth above average until 2026, Hazleton said.

The picture for residential construction is more mixed and is expected to remain “challenged” in 2025, particularly in North America. There is expected to be modest year-on-year spending growth in 2025 in western Europe, after two years of declining spending.

Looking at non-residential spending across the world, industrial spending is set to go into reverse while institutional and commercial spending remain in positive territory but at a slower rate than 2024. One area expected to see stronger spending growth than in the previous two years is in the office sub-sector. Hazleton explained that this is because data centres, which fall into this category, are still proving to be a strong source of new work for construction companies.

Asia-Pacific to lead growth among large economies

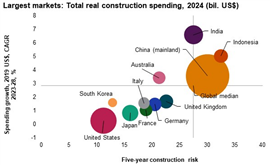

Meanwhile, the large economies that S&P Global expects to see the highest levels of growth are in the Asia Pacific region.

Hazleton shared a chart (below) that positions markets according to both their expected spending growth over the 2023-2028 period and a score based on how risky they are appear to be (in terms of risk to investment, intellectual property etc). The size of the balloon on each chart indicates the size of the market.

Source: S&P Global Market Intelligence (data compiled July 2024)

Source: S&P Global Market Intelligence (data compiled July 2024)

India and Indonesia offered the highest expected spending growth over a five-year period. And China, in spite of a tough economic backdrop in recent times, also promises robust growth prospects, according to S&P Global’s analysis

Only one large economy appeared in the top left quadrant of the chart, which Hazelton indicated was the most desireable area for markets to fall into, signalling both the potential for growth and relatively lower risks to investment, and that was Australia.

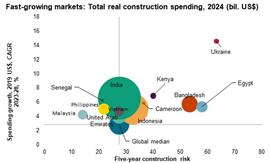

Looking at all markets, including developing economies, Hazleton said that it was Africa and Southeast Asia that offered the strongest growth prospects.

However, there were some outliers, including Ukraine, where the potential for very strong growth spurred on by reconstruction efforts amid the country’s invasion by Russia, is tempered by high levels of risk. Growth prospects in Egypt are also strong but also carry elevated risk levels. Structural reforms are still needed in the country to support the private sector and comply with International Monetary Fund (IMF) conditions for a bailout following a period of rampantly high inflation.

Source: S&P Global Market Intelligence (data compiled July 2024)

Source: S&P Global Market Intelligence (data compiled July 2024)

Strong growth in Middle East despite ‘fiscal realities’

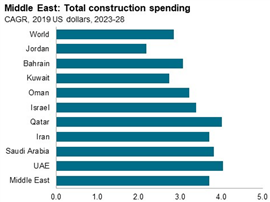

Hazelton said that in the Middle East there had been a pause this year as some “fiscal realities” set in. “There’s a lot of major projects that are ongoing and we think they will continue to be ongoing and we aren’t forecasting a pullback but the pace may be reduced and some of those projects with an end date of 2035 may become 2038,” he said.

He said he expected to see growth, particularly in the Gulf Cooperation Council countries (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates), as oil output cuts are lifted gradually. S&P Global pointed to above-average construction spending over at least the next five years in the region.

While energy has dominated Middle Eastern infrastructure construction investment over many years, future investment is increasingly being channelled into transportation and water and sewer projects. “All economies are making investments in the infrastructure required for the level of growth they have been seeing,” Hazelton explained.

Meanwhile, the non-oil economy is also helping to drive growth in non-residential building in marketplaces like Saudi Arabia, the United Arab Emirates, and Qatar

Source: S&P Global Market Intelligence (data compiled July 2024)

Source: S&P Global Market Intelligence (data compiled July 2024)

Saudi Arabia is leading the way when it comes to growth in the non-residential sub-sector, thanks to a slew of megaprojects under the auspices of Vision 2030. Hazelton pointed to strong levels of growth in the United Arab Emirates too and noted that even if Saudi Arabia were to slow down a little, many years of strong growth are likely to remain.

The Middle East is also seeing significant investment in green energy projects. Hazelton pointed to International Energy Agency (IEA) reports that renewable capacity in the region is expected to increase by 62 gigawatts over 2023-2028, with solar photovoltaic making up over 85% of the increase. One third of the growth will be in Saudi Arabia alone, where, for example, the 77 sq km Mohammed bin Rashid Al Maktoum Solar Park could end up being the largest single-site solar park in the world with up to 5,000 MW of capacity.

As he delivered his presentation, Israel was preparing to launch ground attacks against Hezbollah inside Lebanon and Iran launched missile strikes against Israel.

With that in mind, Hazelton did offer one caveat when it came to the prospects of the Middle East’s construction market, related to the ongoing conflict. “We do not believe it will expand to a regional war. Of course, if that were to happen it would be a very different outlook,” he said.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM